crm

RegTech-Driven CRM

Our CRM solution is built for Money Service Businesses, seamlessly integrating compliance and client management in one platform. It supports both individual and business entities, offering complete visibility into customer relationships while automating compliance workflows. This all-in-one system links client interactions and payments with compliance measures, ensuring real-time tracking, risk reduction, and process efficiency. By combining cutting-edge contact and relationship management tools with rigorous compliance protocols, our CRM allows businesses to streamline operations while maintaining regulatory accuracy.

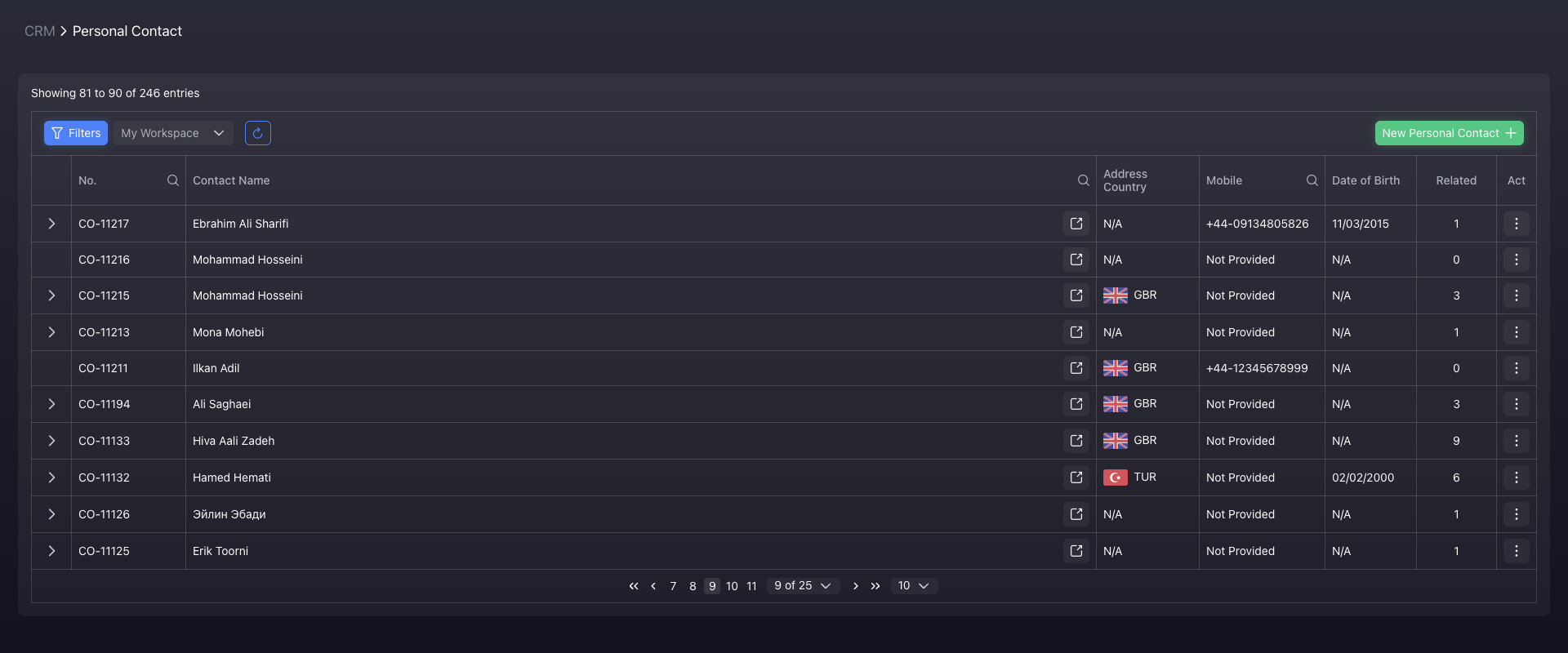

Contact Management

A unified dashboard designed for both individuals and business entities, offering a comprehensive view that includes compliance data, contact network management, transaction history, and full audit trails. This feature enables seamless and efficient contact handling, allowing users to gain multi-dimensional insights into every relationship. Additionally, the dashboard includes continuous monitoring of all contacts, ensuring they are screened against politically exposed persons (PEP) lists, sanctions, adverse media, and any identity changes. By integrating with credible credit reference agencies, it enhances compliance efforts and ensures that contact data remains up-to-date and secure. s

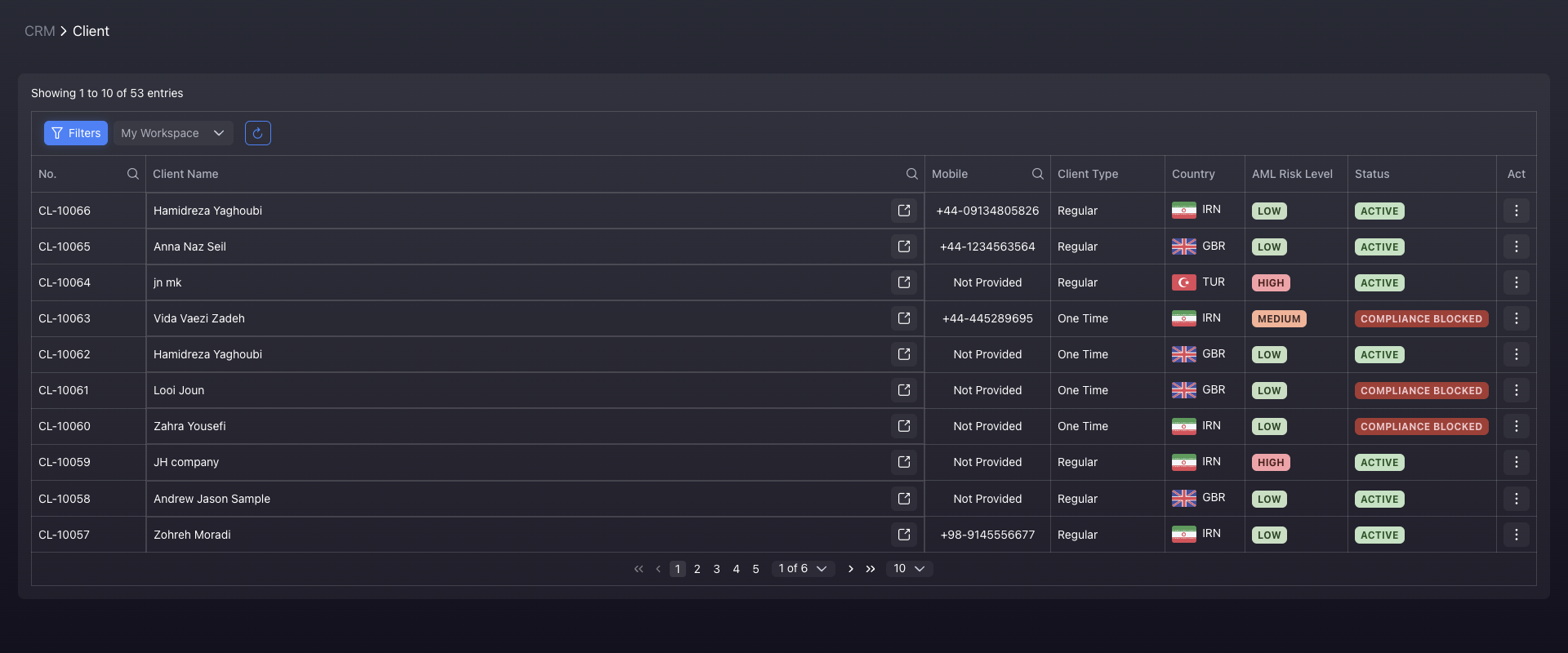

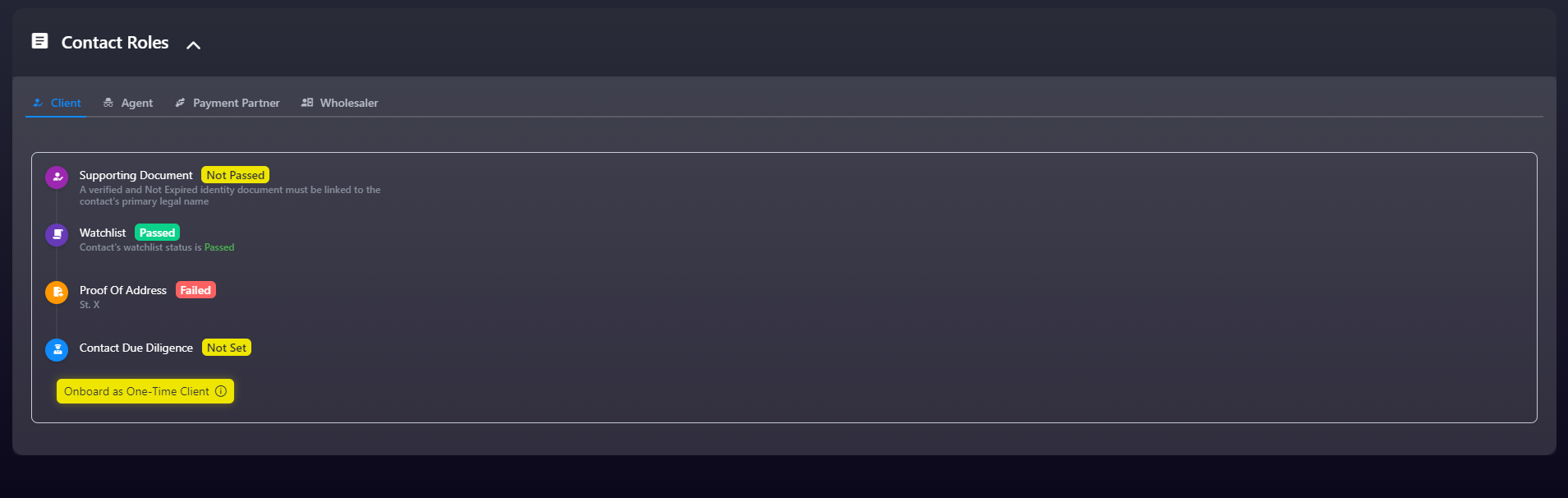

Client Management

Actor Management

A tailored dashboards for partners, wholesalers, and agents, each customized with specific compliance rules and limitations. This feature provides enhanced control and visibility over third-party relationships, ensuring that every partner or agent operates within the appropriate regulatory framework. By centralizing compliance management for external entities, the system streamlines oversight, improves risk management, and enables businesses to maintain stronger, more transparent connections with their third-party partners while adhering to industry regulations.

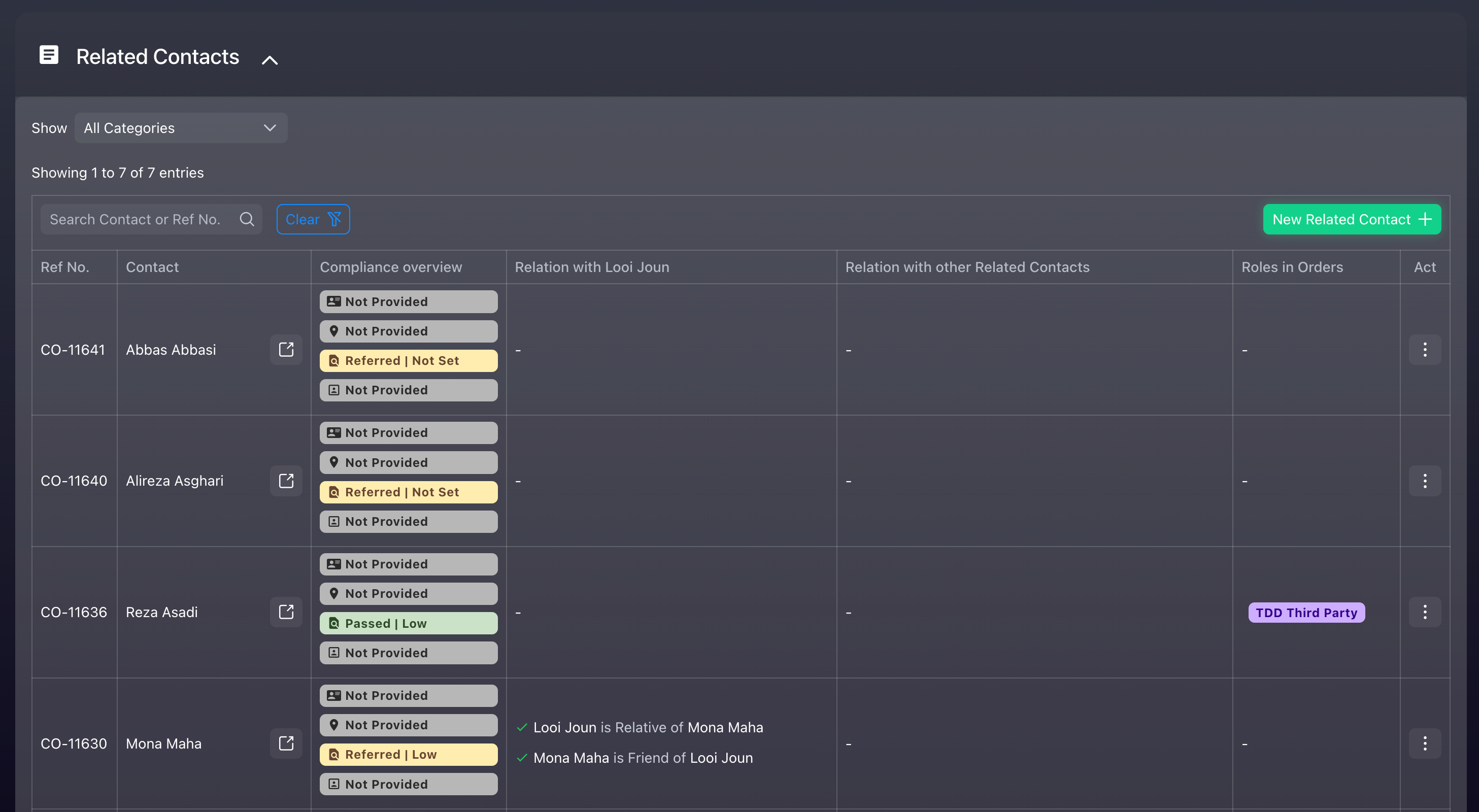

Relationship Management

Our unique framework is designed to effectively manage both direct and indirect relationships, allowing businesses to enhance compliance control significantly. By defining multiple contact types, the system facilitates precise categorization and monitoring of interactions across various entities. This robust approach enables comprehensive oversight, connecting related parties for a holistic view of potential risks. Through continuous monitoring and analysis, the framework provides valuable insights into relationship dynamics, helping organizations identify vulnerabilities, ensure adherence to compliance standards, and maintain regulatory integrity throughout their operations. This proactive management of relationships ultimately supports better decision-making and risk mitigation strategies.