Features

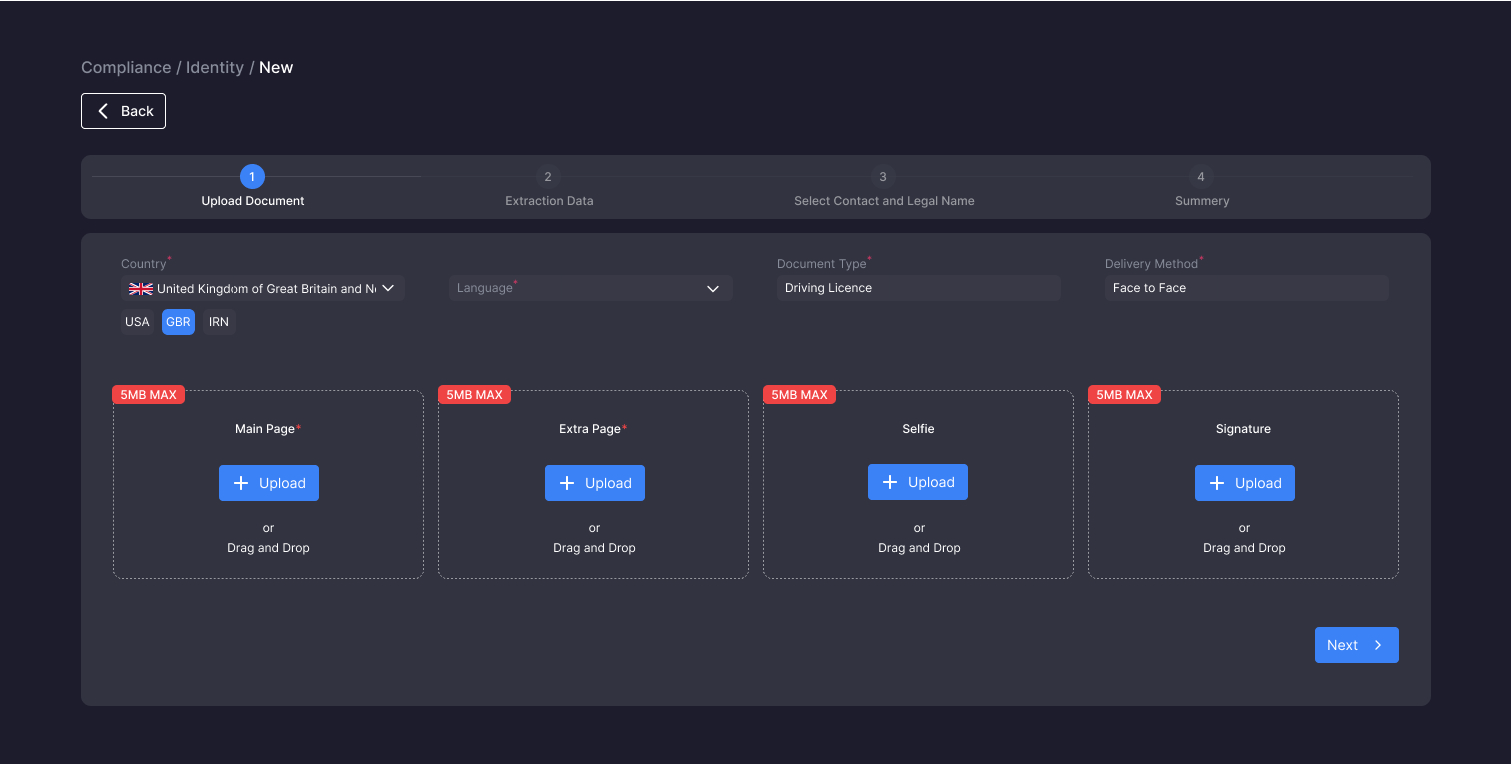

Compliance management

Our compliance solution simplifies the complexity of regulatory management by automating key workflows. Designed to handle even high-risk transactions, it integrates market-leading tools to verify identities, monitor risks, and ensure adherence to Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) standards. With automated risk assessment and real-time monitoring, it reduces manual workload while enhancing compliance accuracy, offering full control over due diligence, KYC, and transaction monitoring. u

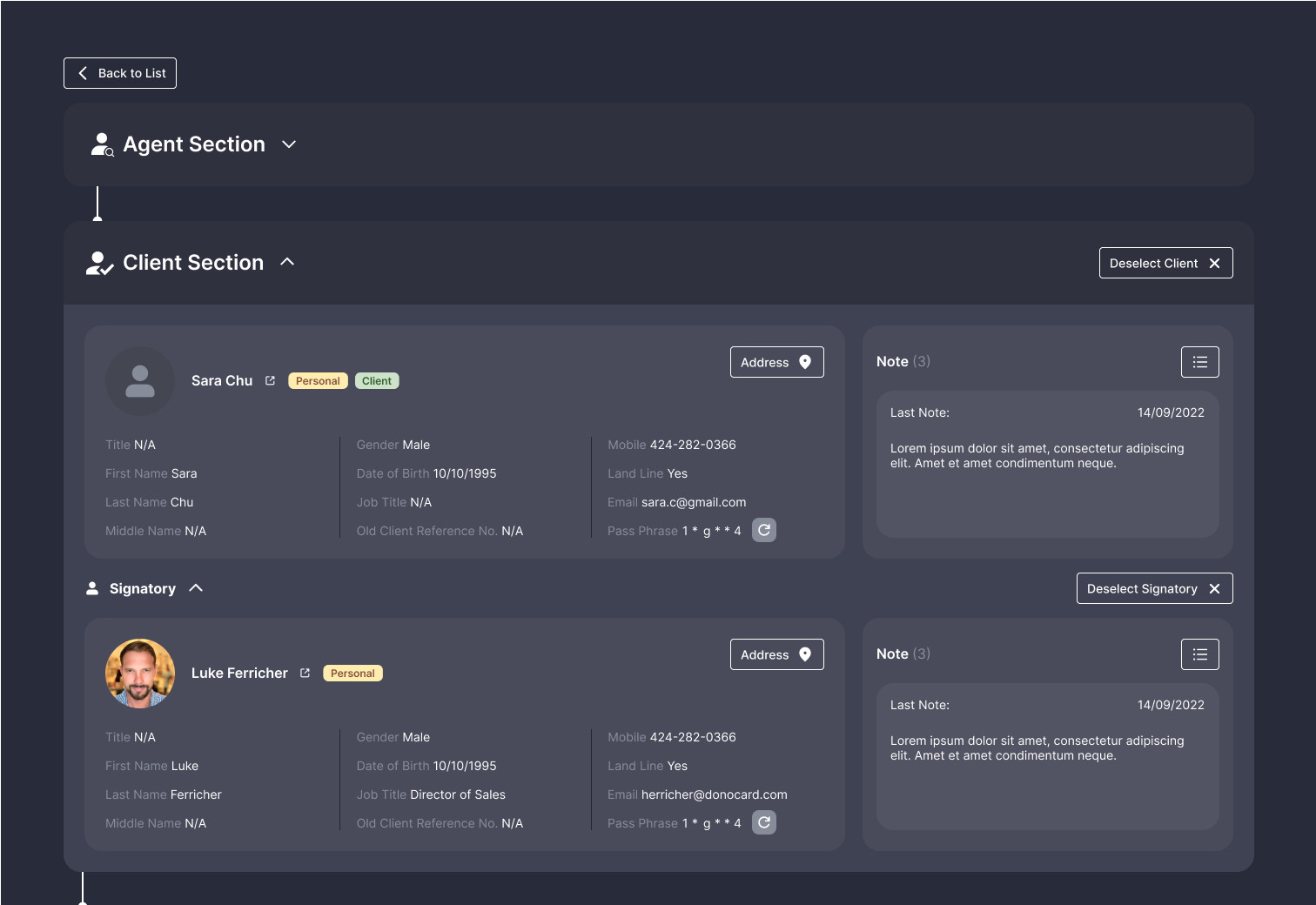

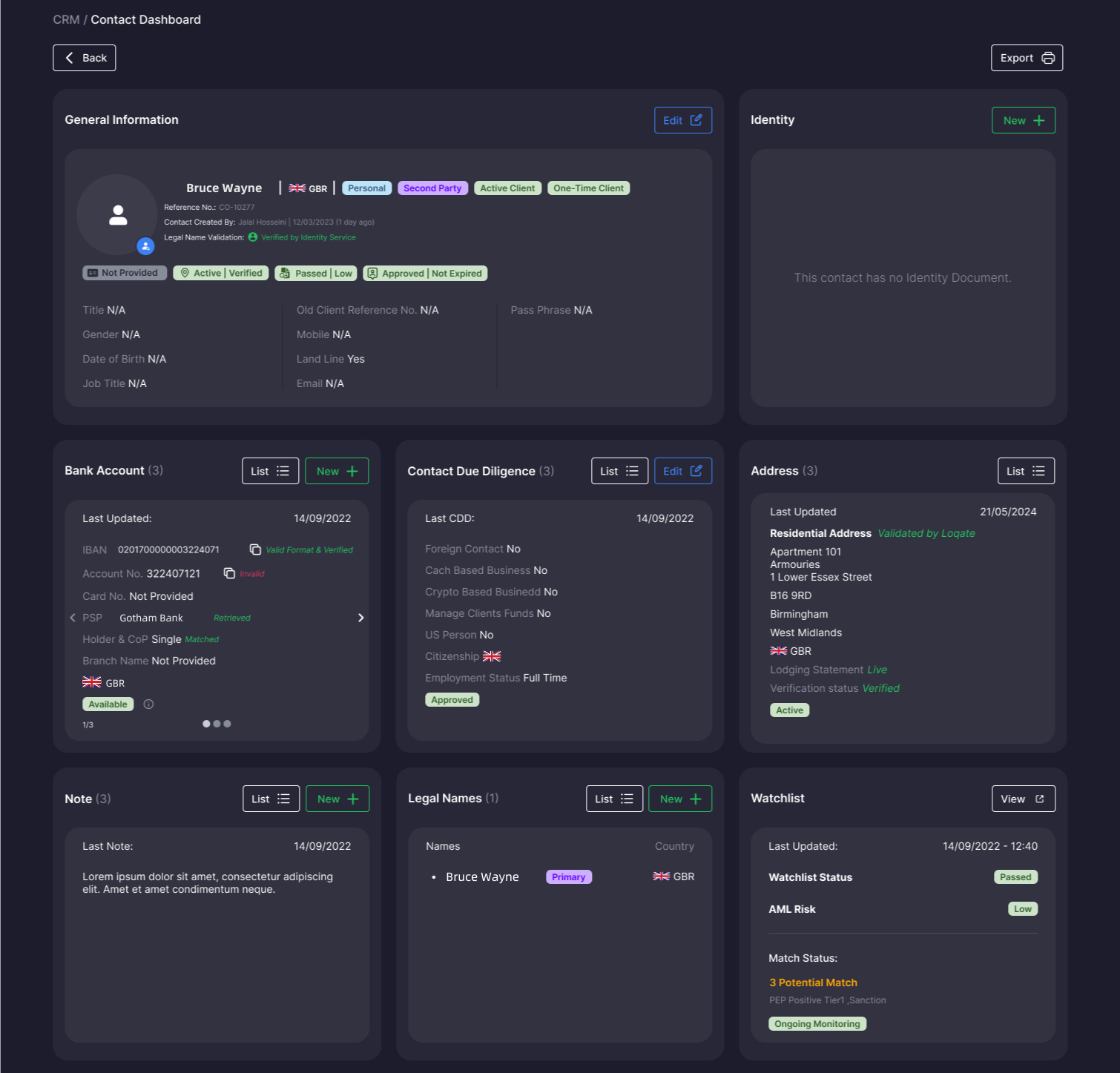

CRM

Our CRM solution is built for Money Service Businesses, seamlessly integrating compliance and client management in one platform. It supports both individual and business entities, offering complete visibility into customer relationships while automating compliance workflows. This all-in-one system links client interactions and payments with compliance measures, ensuring real-time tracking, risk reduction, and process efficiency. By combining cutting-edge contact and relationship management tools with rigorous compliance protocols, our CRM allows businesses to streamline operations while maintaining regulatory accuracy.

Dealing

Our Dealing solution facilitates secure and compliant financial services, from remittance to foreign exchange, with full integration into the CRM and Compliance modules. Every transaction is monitored and controlled, ensuring full compliance with financial regulations while processing orders efficiently. With seamless integration into banks and third-party financial service providers, this module offers speed, security, and total regulatory adherence across all dealing activities.