compliance

End-to-End Compliance Management

Our solution automates regulatory workflows, handling high-risk transactions with integrated tools for identity verification, risk monitoring, and AML/CTF compliance. It offers automated risk assessment, real-time monitoring, and full control over KYC, due diligence, and transaction tracking, reducing manual effort while boosting accuracy.

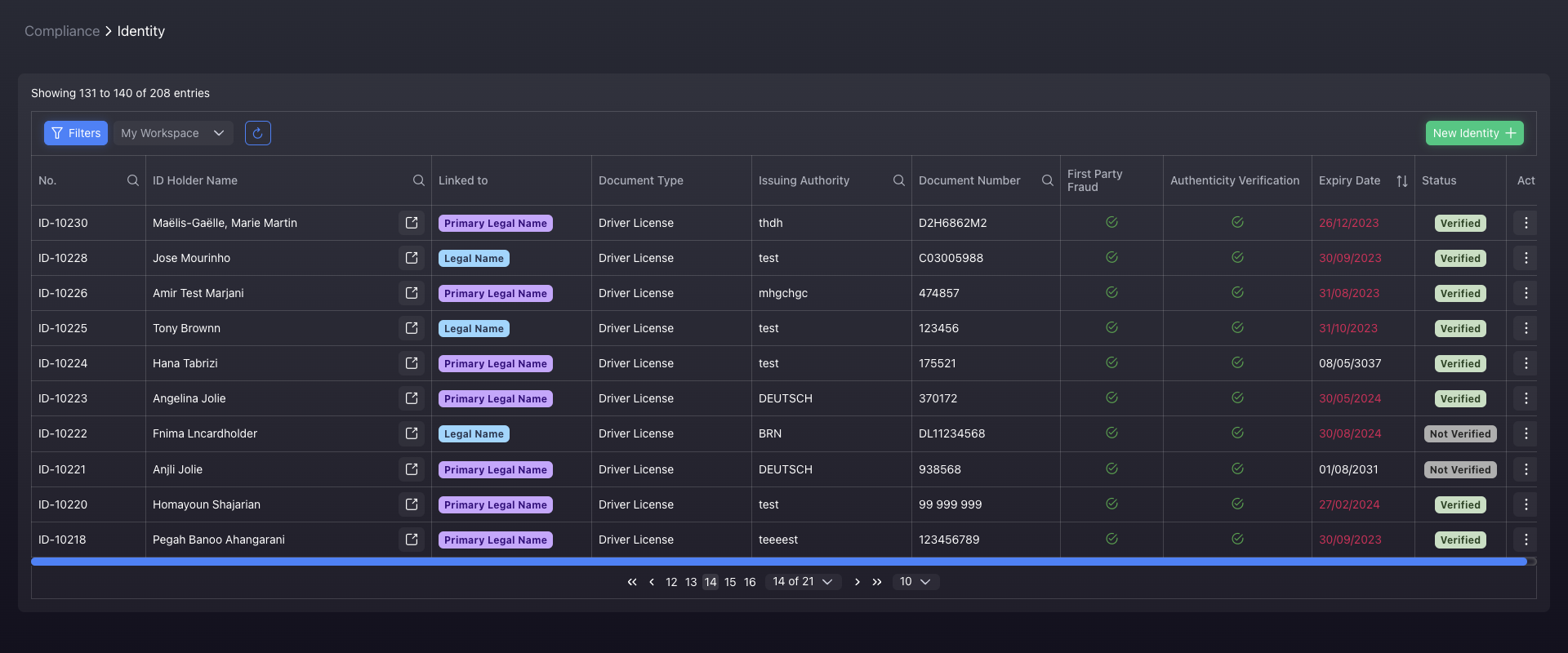

KYC

It provides a 360-degree view of client identities, integrating document verification, credit checks, and address lookups to centralise all identity information, ensure compliance, and integrate with market-leading and most credible credit reference agencies.

Contact Due Diligence

Complete profiling of contacts, capturing everything from residency and nationality to business involvement and intended use, ensuring thorough compliance checks. It includes ongoing monitoring and is integrated with the risk assessment service.

Watchlist Screening

Integrated with ComplyAdvantage to screen and constantly monitor against PEPs, sanctions, and adverse media, with automation that reduces manual effort while maintaining vigilance.

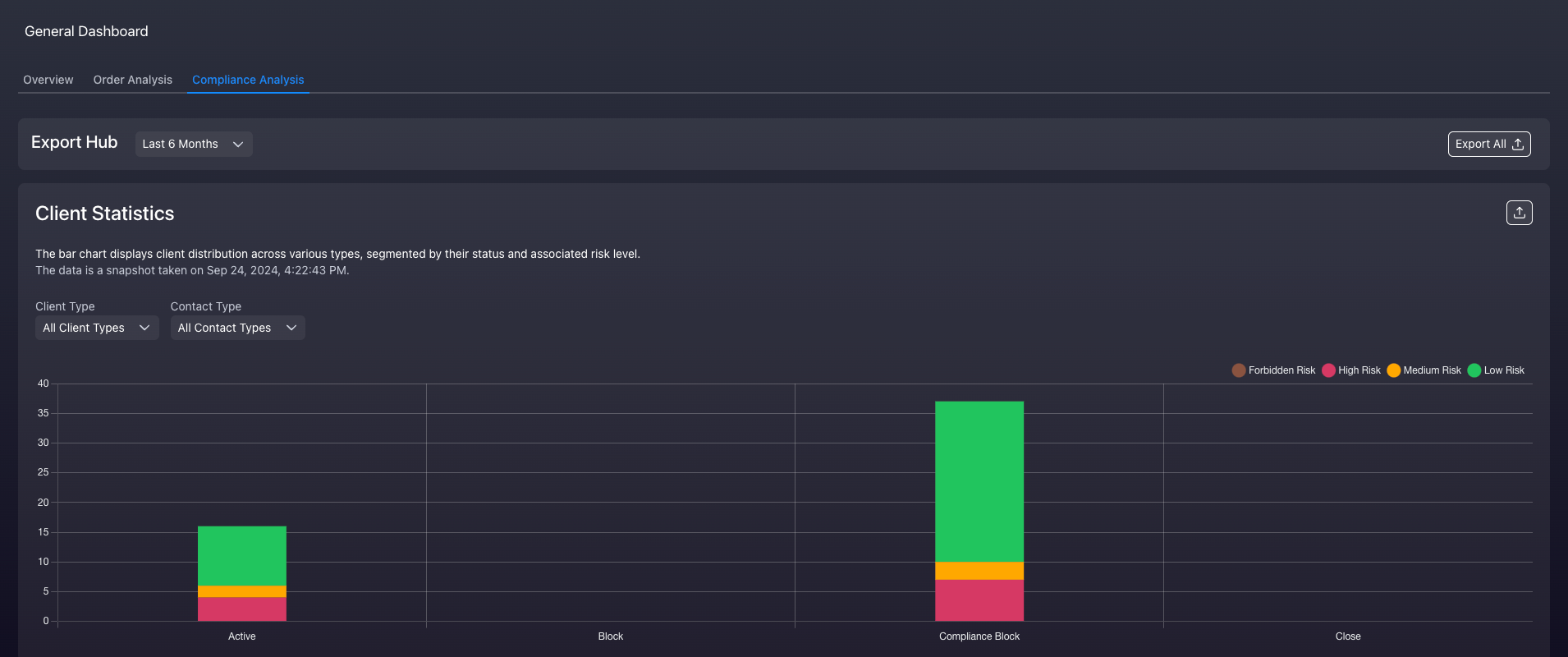

Risk Assessment

Flagright Integration offers AI-powered risk assessment. It provides comprehensive transaction and client risk analysis, automates decision-making, and monitors risks in real time.

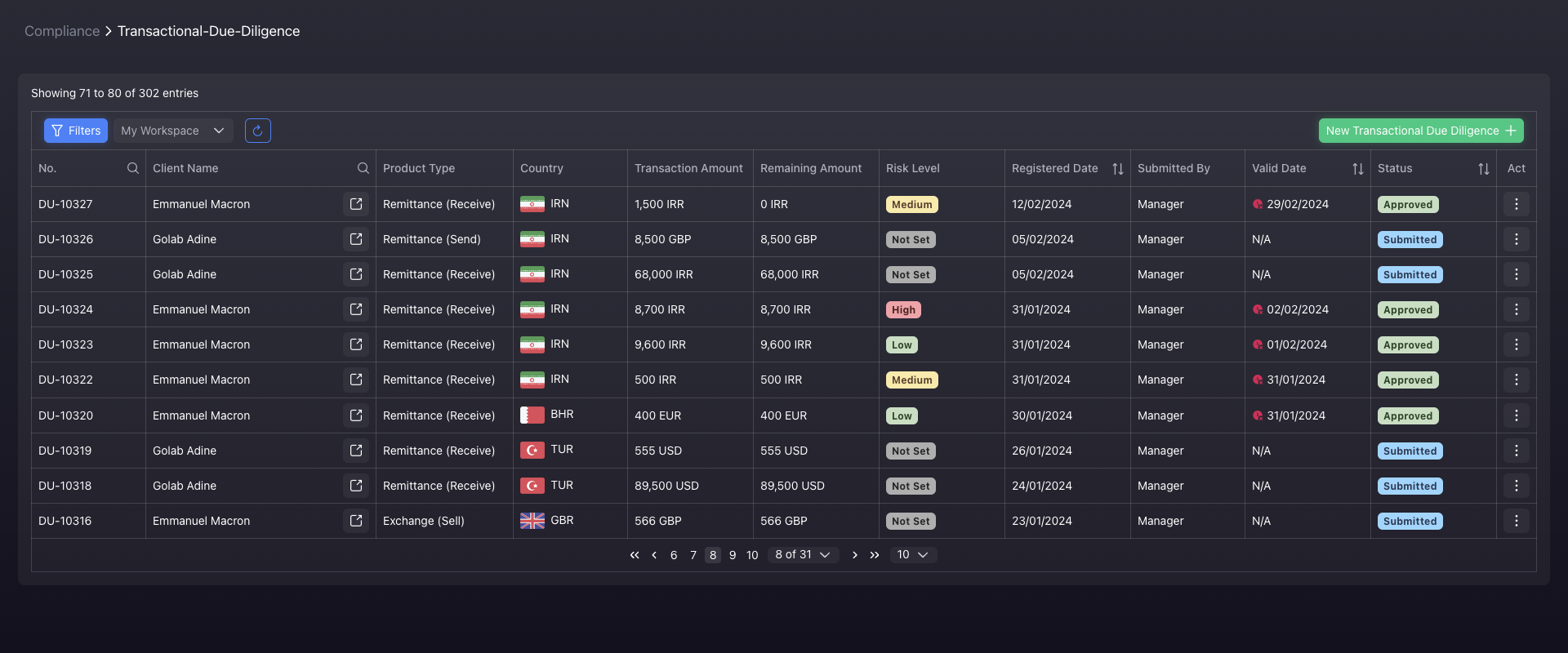

Transactional Due Diligence

The only solution that flags potential risks before transactions are processed. Ensuring compliance by validating transactions at every stage to minimise AML and CTF exposure. It includes a real-time risk assessment engine with a 360-degree view of client compliance and transaction history.